In India, we have a progressive mode of taxation, ie higher income is the higher tax payable. To determine the same taxation in India is determined on the basis of income tax slabs, defined by the tax department. The applicability of New Income Tax Slabs 2020 depends on various factors such as – residential status, amount of income, type of assessee and age.

After the Budget 2020, the proposal on simplification of personal income tax, comparing the old tax system with the new tax system, has become a matter for every taxpayer.

Announcing the new income tax slabs, the Finance Minister said that if a person has an annual income of Rs 15 lakh and is not taking advantage of any deductions, he will now have to pay Rs 1.95 lakh instead of Rs 2.73 lakh annually.

The existing tax slab is 20 percent on the tax slab of Rs 5-10 lakh, while the annual earner of Rs 20 lakh to Rs 2 crore has to pay 30 percent tax. At the same time, a person earning more than 2 crores had to pay a 35% tax. Like the old slab of income tax, there will still be no tax on annual income up to Rs 2.5 lakh and on income of Rs 2.5 to 5 lakh. A 5% tax will have to be paid.

Income tax rates under the new income tax slabs are low but without any income tax exemptions/deductions. The Finance Minister said that in order to make the tax system easy, about 70 of more than 100 income tax deductions and exemptions have been abolished.

Although new income tax slabs are still an option for FY 2020-21, they may become the only option available to taxpayers, as and when the government wishes in the future.

Old and New Income Tax Slabs

| Income | Existing Rate | New Rate |

| Up to Rs 2,50,000 | Nil | Nil |

| Rs 2,50,001 – Rs 5,00,000 | 5% | 5% |

| Rs 5,00,001 – Rs 7,50,000 | 20% | 10% |

| Rs 7,50,001 – Rs 10,00,000 | 20% | 15% |

| Rs 10,00,001 – Rs 12,50,000 | 30% | 20% |

| Rs 12,50,001 – Rs 15,00,000 | 30% | 25% |

| Above Rs 15,00,000 | 30% | 30% |

Exemption and Deduction eliminated from New Income Tax Slabs

If you choose the new income tax slab rates announced in the new budget, you will not be eligible to claim the following tax benefits.

- Leave the travel concession contained in clause (5) of section 10.

- The rent allowance is contained in clause (13A) of section 10.

- Some of the allowances contained in clause (14) of section 10.

- Standard deduction of Rs. 50,000 u / s 16

- Employment / professional tax deduction contained in Section 16.

- Interest under section 24 in relation to self-occupied or vacant property referred to in sub-section (2) of section 23.

- Loss under the head income from house property for the rented house will not be allowed to be set under any other head and shall be permitted to be carried forward in accordance with existing law.

- Any deduction under Chapter VI-A; [Except 80 CCD (2) – NPS contribution by the employer]

- Determined as others

The concessions will continue to be available on the new income tax slabs

- Death-less retirement benefits,

- Pension,

- Leave encashment in retirement

- VRS Amount up to Rs 5 Lakh

- EPF Fund Withdrawal,

- Scholarship funding for education,

- Money received as an honor for something done in the public interest,

- Short-term withdrawals and maturity amounts from the National Pension Scheme.

Can it be returned to the old one after entering the new income tax slab?

Yes, if a person chooses a new tax slab in the next financial year, and then next year he feels that it is better for him to choose the previous tax slab. So he can go back to the old slab again. But the condition in this is that there should be no income of business etc. except the salary of such a person.

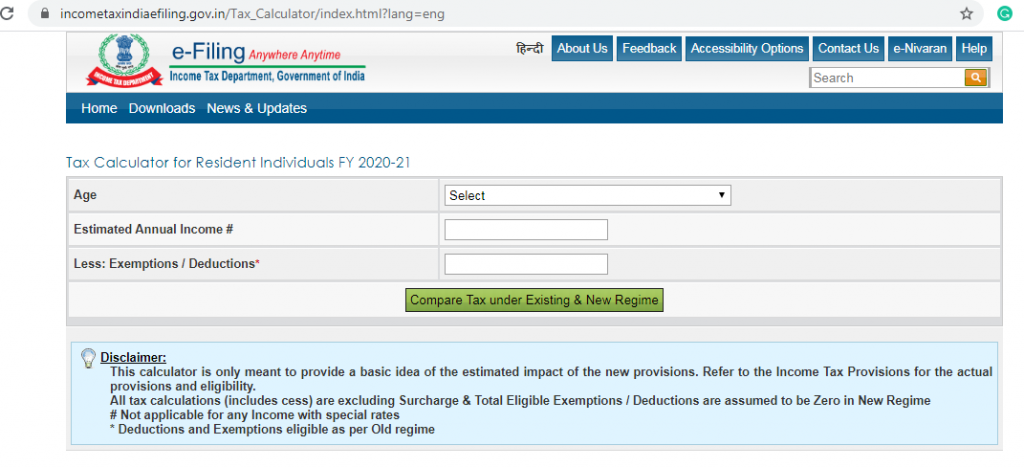

How to use e-calculators to compare New Income Tax Slabs With old

By now, as a taxpayer, one wants to know whether to stick to the old or existing tax or to substitute for a new tax. Therefore, assuming your income and deduction amounts are the same, you can use an e-calculator to find out if the new tax is better or the existing tax suit.

- Go to the e-filing website of the Income Department.

www.incometaxindiaefiling.gov.in - Click on “Tax Calculator FY 2020”

- On the next page, select your age from the dropdown

- Enter your estimated annual income, which is your gross income from all sources

- After that, in the next financial year, you file rebate/deduction.

- Submit by clicking on the ‘Compare tax under existing and new regime’ button

Before making a comparison and taking calls related to your savings, make sure you have a proper financial plan. Savings in taxes, if any, need to be properly allocated towards long-term goals.

Experts say that in fact if a person has a home loan or other investment in a year, then it is better to stay in the old tax system and if in some year he feels that there is no home loan or any other major investment that year, then he The new slab should be adopted again.

1 Comment